Entering the world of trade in shares may feel like piloting a spacecraft without a manual – especially when you hear things such as “algorithms”, “quantitative signals” or “neural networks”. But what if I tell you that you can use commercial bots powered by artificial intelligence-not writing one line of code-and you still feel that you are flying?

Regardless of whether you are a total beginner or someone who simply does not replace the calcricity and scripts, there is a new race of AI commercial tools designed exactly for people like us: without coders, interesting minds and ordinary traders.

Let's break down what all this commercial thing is AI, how it can help you and which are actually worth your attention.

Why AI commercial bots are a great deal (especially for beginners)

Stock market markets are emotional. Ironically, the smartest commercial decisions result from a lack of emotion. AI enters at this point. These bots analyze thousands of data points faster than your human brain can blink – value trends, volume changes, message sentiment, confidential activity – all processed without fear, greed or guessing.

But here is Magic: Bots No Code Ai Trading Bots allows you to use this intelligent technology without the need to learn Python or configure your own server. You just connect your preferences, improve a few sliders and allow the algorithm to heavy lifting. Think about it as employment of a robo-analyst who works 24/7 and never asks for a coffee break.

⬇️ See the best commercial bots AI

What to look for in a code of AI trade bot

Let's not be fooled with bodily interfaces. Here's what you want:

- Pre -built strategies: Are there templates that you can use after removing from the box?

- Reverse testing: Can you test historical data strategies before risking real money?

- Transparency: Does the platform explain how AI works, or is it only black magic?

- Integration: Does it connect to your broker (Robinhood, Coinbase, Binance, etc.)?

- User interface: Can your grandmother use it? If not, think.

Universal cases of use (and real vibrations)

- You are a beginner who wants a “autopilot” trade in shares during learning.

- You work full -time and you can't look at the charts all day.

- You are fed up with memes and you want something based on data.

- You want diversification between crypto, wrestling and Forex market.

If you nod any of them, the bots that we intend to discuss can be your new BFF trade.

Table of contents – the best commercial bots of AI shares (without code)

- You have atera

- Tickeron

- Intellect

- TradingView

- Coinrule

- Kavout

- Tradeideas

- Tradesant

- Bitsgap

- Signal pile

What is this?

Aterna AI is like a assistant to think. It is built for those who want artificial intelligence who seem less robotic and more intuitive – like a commercial mentor who speaks your language.

Key functions

- Generating strategy based on conversational introduction

- Non -standard portfolio risk profiles

- A layer of commercial explanations – why does he take action

- Long/short actions with occasional cryptocurrency suggestions

Cases of use

Perfect for people who want to understand Why Trade is made, not only blindly. If you build self -confidence and want to grow with a bot, Aterna's “explanation” gives you peace.

My verdict

It's a bit like having a clever friend, whispering in the ear market tips. A huge win if you are both interesting and careful.

What is this?

Tickeron scans markets in terms of technical patterns, confidential activities and information sentiments – and then gives commercial ideas on a silver plate.

Key functions

- AI pattern search engine (hello, flags, triangles, wedges)

- Trade signals based on testing

- Assessment of confidence in prediction (nice touch!)

- PRO strategy market

Cases of use

Ideal for people who want to learn technical analysis along the way. You can see how patterns lead to transactions and adapt them to your own needs.

My verdict

Visual students, this one is for you. Prognostic charts are addictive over the border.

What is this?

Think about Intexia as a maniac that loves you. It focuses largely on market forecasts powered by artificial intelligence, which gives probability, not unclear “buy” suggestions.

Key functions

- Predictive models on actions and ETFS

- Dynamic signal generation

- Tools for balancing the portfolio

- User -friendly navigation desktops

Cases of use

Ideal for strategic nerds who do not want to encode, but still love to forecast models and risk assessment.

My verdict

It's a bot ai for data romantics – if you love patterns, charts and numbers, the intellector will flirt with your inner amount.

What is this?

NO Just The platform of charts-TradingView now integrates signal bots based on artificial intelligence and scripts of other companies that can be used or maple.

Key functions

- A huge community of traders dividing the scenarios

- Pine scenario editor (optional)

- Alerts, signal bots and integrations with brokers

- A beautiful user interface that makes you feel smart, even if you're not

Cases of use

Ideal for DIY traders who want full control, but also the option to copy smarter people. Users without code can use shared strategies without touching the code.

My verdict

It's like Reddit + Bloomberg + Excel on steroids. If you want to learn socially, go here.

What is this?

Coinrule is a Lego set for commercial strategies. “If that,” but in the case of stocks and cryptography.

Key functions

- Builder of dragging and dropping rules

- Pre -built shoot templates, RSI, has a crossover

- Re reverse test

- Connects with brokers such as Binance, Coinbase and some API interfaces

Cases of use

For DIY who like control but hate code. You will love how easy it is to test the “What if” scenarios.

My verdict

Honestly? One of the most satisfying user interfaces. It's a bot ai for creative thinkers.

What is this?

Kavout uses machine learning and large data sets for stock ranking using the “kai result” – a mixture of bases, shoot and price operations.

Key functions

- KAI result for action

- Portfolio modeling tools

- Based on data with minimal down

- Integrates with data at the level of hedging funds

Cases of use

You want rankings, not rules. Just tell me what the best supplies are.

My verdict

If you are “just tell me the best”, Kavout hits this sweet place.

What is this?

Tradeideas is like caffeine for traders. He is fast, loud and wise. Their artificial intelligence, “Holly”, scans live markets and provides strategies.

Key functions

- Real -time ideas scanner

- AI models that test thousands of strategies

- Brokerage integration

- Paper trading mode

Cases of use

Made for quick removals – day traders, scalpers and market junkies.

My verdict

If you get in a hurry from action, this is your spiritual spirit.

What is this?

Originally a cryptographic bot, the tradesant, now supports several traditional resources and offers easy automation.

Key functions

- Mesh and dca strategies

- Support for many exchanges

- A simple interface

- Bot template market

Cases of use

Cryptocurrency traders who want to try their hand in a warehouse without jumping on a new platform.

My verdict

Skillful and simple. For example, if Coinbase created a bone-bone bot.

What is this?

Bitsgap connects many exchanges, which gives a single control panel for all your trading bots.

Key functions

- Unified navigation desktop

- AI powered bots (mesh, arbitration)

- Reverse testing

- Supports crypto, forex and indexes

Cases of use

For people juggling accounts on many stock exchanges – great for both cryptocurrencies and traditional traders.

My verdict

If your bookmarks are always overcrowded, you need a bitsgap view.

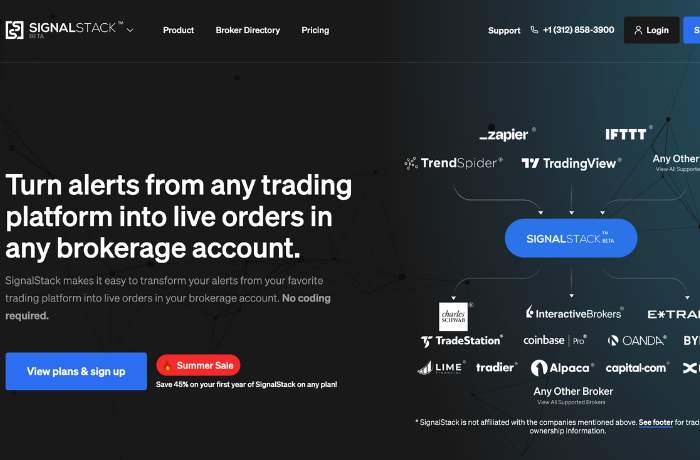

What is this?

A signal pile is not the bot itself – but it allows you automatize Signals from your favorite tools (such as newsletters, trade notifications, etc.).

Key functions

- Automatically transforms notifications into transactions

- Works with brokers and exchanges

- No code configuration

- Logic based on webhook

Cases of use

Perfect for the junkie of the newsletter or the community signal – you get notifications, and the signal pile places transactions for you.

My verdict

It's automatic glue. Brilliant, if you already know what you want to trade, but you don't want to look after the screen.

Final Thoughts and 3 best types

After diving on these platforms, here I would sum up:

🏆 Best in general – Coinrule

An ideal mix of power and ease of use. You can build, test and run strategies without feeling that you are debugging a nuclear reactor.

🔍 Best for learning – ATERNA AI

If you want understand What is happening and develop your skills, Atena makes artificial intelligence explained – and this is worth golden for beginners.

⚡ Best for fast points-handludeas

Nothing is approaching for adrenaline traders. Real -time scans, types based on AI and shoot notifications that keep pulse races.