Have you ever wondered if Crypto AI commercial bots actually work – if they are just smoke and mirrors?

I spent weeks testing eleven platforms – some strategic engines, others warn bridges – all accosted to Coinbase Pro or Binance via API. I wanted to see how they work in real trade conditions. What stood out, what was floping and which bot can match exactly what you are looking for? Let's start.

Why use the AI cryptographic bottle bot?

These bots can bypass the clock, withdraw emotions from trade, test strategies, and even perform transactions on the basis of complex rules. But the hook chooses one that suits your trade style-are you an investor for people dealing with the hand or strategy designer.

How I tested them

- Connected each tool via API/Webhook to the test exchange account

- He launched strategies or live alerts with small capital

- Focuses on utility, strategy flexibility, tools in the test and support

- He compared what every bot has compared to what he promises to deliver

⬇️ See the best cryptographic bots AI

Which really counts in a good bot ai

- Strategy types: Grid, dca, trend observing, recognition of patterns

- Execution: Native Trading API vs Alert/Webhook Pathways

- Ease of use: Configuration complexity, interface flow

- Transparency: Reverse tests, risk data, withdrawals

- Cost and value: free process, price levels, access to functions

The best cryptographic commercial bot: Here's what I found

- You have atera

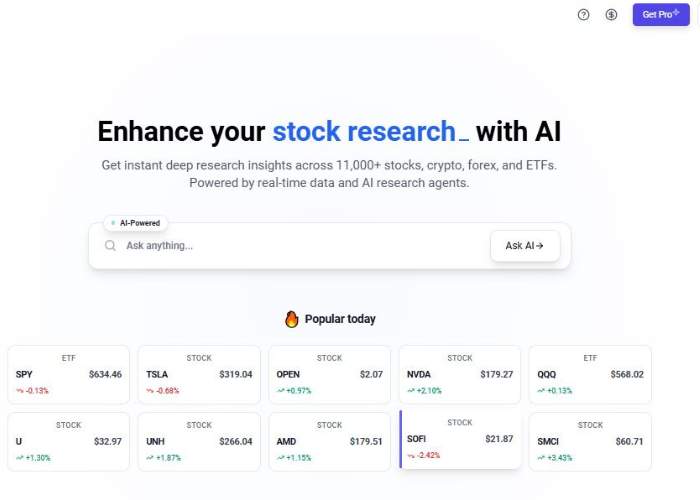

- Tickeron

- Intellect

- Coinrule

- Tradeideas

- TradingView

- Tradesant

- Kavout

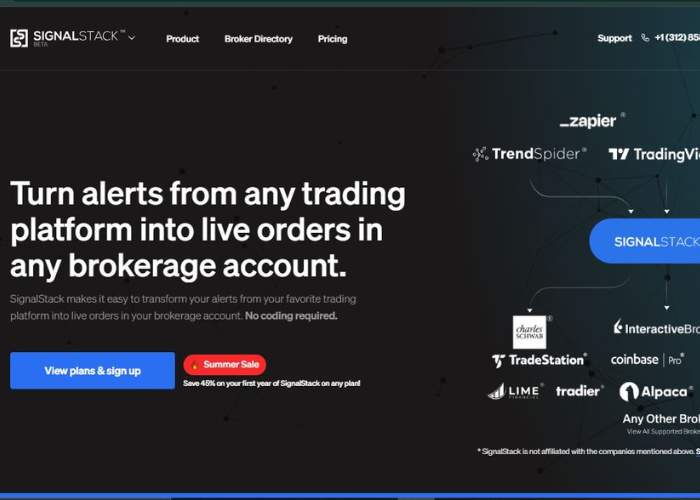

- Signal pile

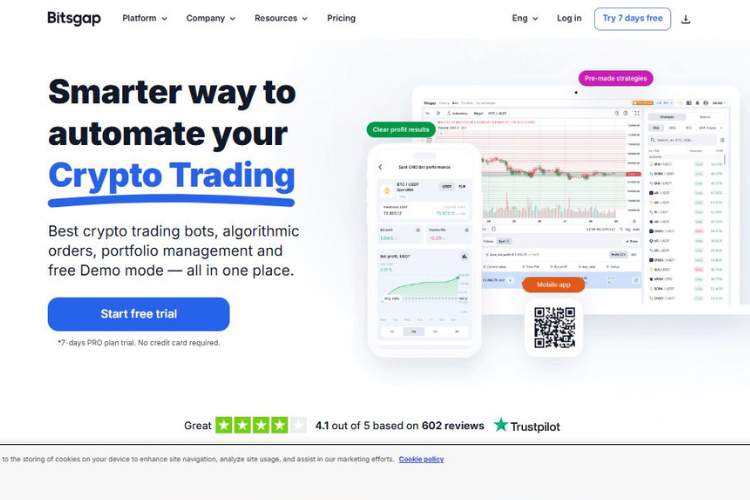

- Bitsgap

Basic functions

- Handle

- AI -based pattern detection

- Dynamic risk size

- Claims ~ 4.3% monthly refund with <4% maximum payments based on verified results 2024.

Best for

Busy professionals who want passive automation without continuous monitoring.

My opinion

The configuration was smooth, transactions performed without confusion. The results seemed realistic – but public transparency is light. Promising, but trust is built over time.

Basic functions

- Single -mazerski agents ML

- Detection of candle pattern

- Rearview tests

- Pre -rebated day trader “or” momentum “

Best for

Traders who want to focus AI signals on one assets such as BTC or Sol.

My opinion

Plug-and-play easy. You can set up an NVDA agent and let him act. Current restrictions if you want strategies of many kin or non -standard configuration.

Basic functions

- Swing trade signals based on sentiments, bases, XGBOOST/ML

- INVESTGPT chat interface

- Analysis of many KIN

Best for:

Traders based on data who prefer to make decisions conducted by Insight than full automation.

My opinion

The signals are refined and helpful. The implementation of the API interface is absent-valuables lead to manual or injected transactions in Webhook. Still, it led my time and size well.

Basic functions

- Based on the rules of IF-Then Builder

- Strategy market

- Reverse testing

- Exchange integration, including Coinbase and Binance

Best for

Traders who want automation without code in many exchanges with templates and flexibility.

My opinion

Building a strategy (e.g. DCA RSI -Cross) in flight seemed intuitive. Connecting and performing real transactions was clean and fast.

Basic functions

- Holly AI engine

- RECIAL DSMAKER TESTING

- Trade rush module, trade signals based on alarm

Best for

Aadvanced Swing/Day Traders looking for deep signal scanning and independent performance through the integration of Webhook.

My opinion

Market scans are intense, sharp signals – but there is a steep learning curve. Provides power after its mastery.

Basic functions

- Non -standard designer of the scenario strategy

- Alerts

- Chart

- Social script market

- Execution via the connector (e.g. wundertrading)

Best for

DIY Traders Building strategies that want full flexibility with vigilance.

My opinion

Very powerful if you feel comfortable. Strategy tuning requires effort. It works incredibly well in combination with tools to make.

Basic functions

- Cloud bots serving DCA, net, Futures contracts

- Binance and Exchange Auto-Connect, templates, following the organization

Best for

Users want a simple, reliable bot automation with template strategies.

My opinion

The configuration was almost reliable. The templates work well and have stability – a great option if coding is not your thing.

Basic functions

- Kai score

- Intelligent signals in Crypto & Stocks

- Language InvestGpt chat

- Portfolio diagnostics

Best for

Traders prioritize the insight of the signals over automation.

My opinion

The signals are refined and disciplined. Lack of trade from the platform-but the quality of the signal is strong to make decisions.

Basic functions

Transforms notifications from TradingView, Trendspider, etc. into automated transactions performed in ~ 0.5s in stock exchanges and brokers

Best for

Traders who build notifications and want to make zero delay.

My opinion

Slim and reliable. It seems that automatic glue – it occurs if you are involved in notification coding and need to be a solution.

Basic functions

- Support for many exchanges

- Grid, dca, combo bots, portfolio tracking and back tool test – but only crypto, no wrestling

Best for

Serious managers of multi -person cryptographic portfolios.

My opinion

Perfect for cryptographic traders using many exchanges. But it does not apply to warehouse users.

Comparative table

| Tool | Best for | Strategy style | Automation type | Ease of use |

| You have atera | Trends supporters | Ai-Epattern, Set and forget | Full native exec | Very easy |

| Tickeron | Bots with a single pattern | ML agents (candlesticks) | Full exec through your own system | Easy |

| Intellect | Thorough signals of the swing | Sentiment & tech ml | Alerts/in optional webhook | Moderate |

| Coinrule | Automation of rules without code | IF – these are the rules of the rules | Native exchange bots | Beginner |

| Tradeideas | Advanced signal scanners | AI scanning alerts | Alerts -> external exec | Power user complexity |

| TradingView | Custom strategies | Non -standard pine script | Webhooks defects via the connector | Advanced configuration |

| Tradesant | Reliable bottle bottles | Grid, DCA, Futures | Native Automation | Very user -friendly |

| Kavout | Signal based analysis | Point signals | Alerts/textbook | Inspected |

| Signal pile | Alarm execution bridge | Every logic of alerts | Webhook Trade Execution | Slim and reliable |

| Bitsgap | Cryptographic bots with many measurable | Grid, dca, combination | Native Exchange Automation | Utility focused on cryptocurbs |

Application and 3 most important recommendations

My best types based on real tests:

1. Coinrule -in the case of flexible automation without code between exchanges. The best mix of usability and performance.

2. Tradesanta – If you want a reliable mesh/DCA/Futures Bots operating on an autopilot. Slight friction, reliable performance.

3. Signal pile – Ideal for people with non -standard signal systems who simply want fast, painless performance. Maintains the complexity of the strategy, not the sewage system.

Other tools also shine:

- Intellect Or gold if you value insight into automation

- Tickeron It is useful to focus one asset

- Tradeideas is unmatched in the depth of scanning

If you are new – start with Coinrule or Tradesant. If you adjust the strategies – use the tradingview stack + signal. If you want insight-powered insight-intellectia fits best. Choose based on how much code vs you want, vs control vs autopilot and insight vs.