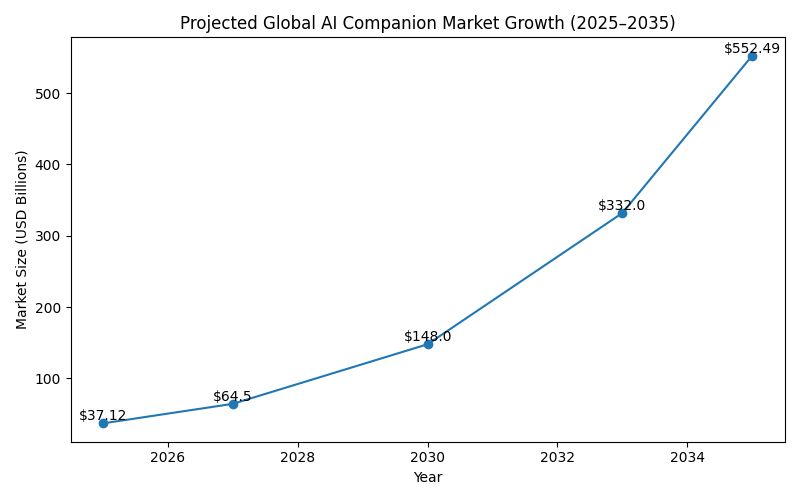

1. Market size of global AI companion industry: $37.12B (2025)

I stopped scrolling at $37.12B. That’s not “a new app trend,” that’s a category with actual economic heft.

This level of value creation indicates that AI companions aren’t just night time hobbies, but things people pay for on a regular basis.

It also indicates the existence of a value chain: builders, prompt marketplaces, safety solutions, payment systems, and “companion-first” design patterns.

Check the full report details: https://www.precedenceresearch.com/ai-companion-market

2. Projected market size: $552.49B (2035)

I don’t believe in projections, but I respect them because they represent market sentiment.

A $552.49B projection isn’t predicting a killer app – it’s predicting an ecosystem.

Assuming even a modest fraction of this comes true, it would make companionship apps standard, like streaming or social media: not “one-night stand,” but “long-term relationship.”

This would likely involve more competition, more oversight, more consolidation. Numbers like this typically draw in funding, and funding draws in imitators – which often accelerates development.

Source: https://www.gminsights.com/industry-analysis/ai-companion-app-market

3. Growth rate: 31% CAGR (2026–2035)

That’s a 31% CAGR over almost 9 years. That’s not a blip, that’s not a bump — that’s compounding.

I said in my notes: “That’s what you see in categories before they get boringly normal.”

The important thing about this is that it implies persistent value — they’re getting emotional support, entertainment, daily companionship, or identity experimentation — which gives you a glimmer into where the business ethics come into play.

If that’s the scale of the growth rate, there will be a lot of incentive to keep those users hooked.

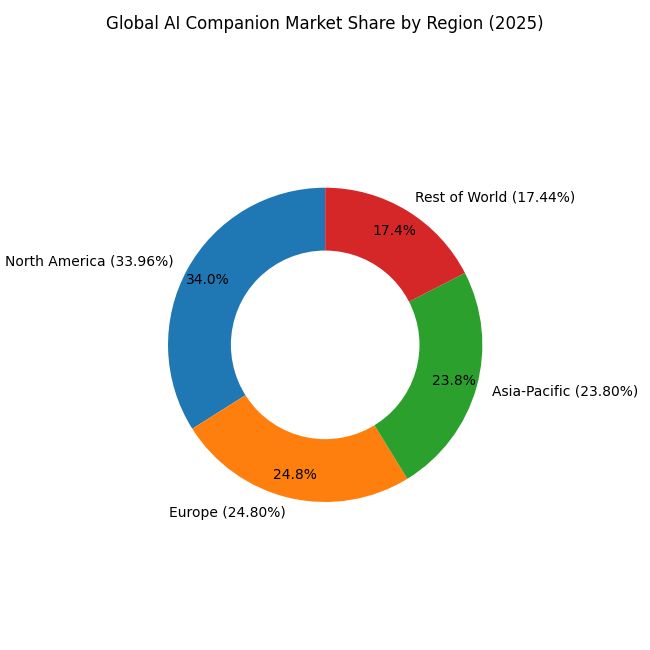

4. North America share: 33.96% (2025)

The fact that almost a third of the global market resides in North America suggests two things to me: (1) people are willing to spend money, and (2) we’re culturally ahead.

The patterns of subscription, digital comfort, and app ARPU are all contributors.

However, there’s also a nuance here — if the majority of the spending power comes from North America, then the products are tailored worldwide for North American tastes — whether it’s the various tiers of pricing or the guidelines of what can be depicted.

This is how “worldwide” products end up feeling as though they’re designed for a single geography.

5. Format share: Text-based chatbots = 44% (2025)

Most folks are thinking voice and video — but most of the usage is still text. That’s not surprising. Text is a lot cheaper to produce and a lot easier to moderate (relatively).

It’s also more intimate than voice, and — as with many video games — users can “fill in the blanks” to give the experience a more personal feel than, say, 3D avatars.

The implication of this for product strategy is that, even in 2025, the majority of companionship is conversational text.

Voice and video may expand, but text is still the majority usage that people access daily because it can be done anywhere, even in public.

6. Vertical share: Consumer sector 38% (2025)

That statistic helped me shift my mindset from thinking about chatbots as “tech novelty” and more as “consumer behavior.”

A segment this massive can’t be explained by tech-savviness or some compelling business case — it’s all about human habits, desires, needs, and impulses.

This fundamentally shifts a lot of things — user expectations, tone, ethics, and revenue model.

Consumer-facing products need to focus on customer retention, which in turn incentivizes emotional attachment.

This has huge implications for the industry: the more consumer-facing a market segment is, the more it becomes subject to social media dynamics — attention, addiction, and designing for “relationship permanence.”

7. North America Market Size: $12.61B (2025)

12.61B isn’t “share”. It’s depth. It’s the region isn’t just “dating” partners, it’s putting its money where its mouth is.

This practically means, NA is where monetization models are tested: subs, token based economies, premium moments, voice packs, avatar customizations.

What works here, will be taken abroad. What meets severe pushback here, will be adjusted everywhere. My interpretation when I see a number like that is: “This market doesn’t just follow, it leads.”

8. Market Size In US : $8.70B (2025)

Why is the U.S. number important? Because it’s concentration within concentration, suggesting that a significant proportion of the category’s financial influence – and hence product choices – are driven by American demand.

The effect is not just market size but also cultural impact: what features are emphasized, how relationship styles are promoted, how safety is treated, what is monetized, what is censored.

For any entrepreneur here, it’s a sign that when it comes to dating, America is often the “typical user,” even for an ostensibly global product.

9. European Market Size: $9.20 Billion (2025)

“Europe” at $9.20B is more impressive than it looks, because Europe isn’t the best climate for high-friction consumer tech.

Users are more concerned about privacy, regulations are more stringent, and the industry is more skeptical. So when the value adds up to a number this large, you know it’s winning despite that. Industry impact:

European growth has a way of encouraging companies to implement more compliance, to get more explicit consent, and to build more robust guardrails.

It’s where “trust design” moves from being a branding strategy to being a necessary condition for business survival.

10. Asia Pacific Market Value : USD 8.84 Bn (2025)

APAC at $8.84B: The size of the APAC market suggests there’s huge opportunity in mobile-first companions.

APAC is typically the driver of character culture, avatar-based identity and social media experimentation, which all spill over into companions. This implies two things.

First, product cycles can be shorter: try out more designs, roleplay features and mixed media interfaces.

Second, a companion will be not a category, but a feature in other categories — chat, games, creator platforms and community-governed characters.

11. Consumer Spend: $221M (as of July 2025, apps only)

This is a “money removes doubt” metric. $221M in consumer spending by July tells me that people weren’t just downloading, they were paying for the apps. And in companion apps, payment is usually for ongoing access, tokens, or premium relationship features.

This means that monetization becomes a competitive weapon: who can offer better personalization, better memory, better content pacing?

It also means that the ethics around these products get more serious: when emotional experience drives revenue, the companies need to be very careful about designing for addiction.

In 2025, AI companion apps will rake in an estimated $120M

12. Revenues: +64% in H1 2025 compared to H1 2024

64% YoY implies the industry is getting more efficient in its upsells – and retention.

That’s not just marketing – that’s product learning. The wider consequence is the change from “build a cool bot” to “build a sustainable relationship product.”

More segmentation (friendship vs dating vs roleplay), more pricing experiments, more premium features that are emotionally perceived as upgrades: more memory, faster responses, higher levels of intimacy, richer media.

This kind of growth will attract copycats – and eventually, we’ll start to see some standardization around “premium companionship.”

As of now, AI companion apps are projected to earn $120M by the end of 2025.

13. Revenue concentration: Top 10% of apps earn 89%

This is just typical “category economics”. The top 10-20 guys figure out the retention playbook, hoover up 90% of the revenue, and then everyone settles down.

The result is further consolidation – the top guys will reinvest into even better AI models, deeper content libraries, better creator programs, more marketing etc, and just keep leaving everyone else further behind.

The rest of the apps will either specialise (specific fantasies, therapy style services, fandom characters etc) or be sold. When I see a chart that says 89% of the market is concentrated in the top few guys, I don’t think “unfair”.

I think “the rules of the category have been figured out, and everyone else is still experimenting”.

AI companion apps will generate $120M in 2025, according to a report published today.

14. Middle class develops: ~33 apps were over $1M in lifetime spend

33 apps getting to $1M in revenue is important because it implies there are multiple, rather than just 1-2 huge players.

This leads to innovation – competing teams can afford to exist, so we see lots of experiments around user experience (story feeds vs “discover” reels), monetization (tokens vs subs), and safety features.

And, we can assume users have varied tastes within companionship (from “cozy friend” to “intense roleplay.”

AI-powered companion apps are on pace to earn $120 million in 2025, according to data shared by Sensor Tower Intelligence.

15. 2025 trajectory: $120M in 2025 (as reported)

I interpret “on track” as a trend indicator, rather than an absolute figure – but it’s significant. It implies the market was big enough for analysts to predict a full year revenue run rate.

The effect is branding: revenue figures attract investment, media coverage, and competitive products.

It also informs user perceptions, since once something is deemed “big business,” users begin to expect more service, less bugs, and more articulated policies.

To grow is to be dissected – and to be dissected is often to be defined.

16. Scale: 60M downloads (self-reported from their companion apps)

Downloads are a flawed metric, but 60M indicates to me that the category is in mass experimentation phase.

At those numbers, users aren’t just coming from Reddit, Hacker News and Twitter.

They’re coming from Search on the app stores, Instagram, TikTok and text message conversations.

Cultural implications aside (where the more the masses play with companions, the more normal it gets, and the less “weird” it is to interact with AI) implications for builders are onboarding for the curious, power features for the daily, and safety infrastructure for the (un)predictable at scale.

Source: https://www.techinasia.com/news/ai-companion-apps-on-track-to-hit-120m-in-2025

17. Revenue per download $0.52 -> $1.18

This is the ‘unit economics is getting better’ stat. 2x revenue per download implies not just more installs, but higher conversion and retention too.

This means companion apps can afford to pay more for users – so competition and category growth accelerate.

It also means that product design shifts more toward premium differentiation – length, realism, voice, image, relationship depth.

I read it also as a warning: if money is tied strongly to emotional reward, companies must be careful to not use exploitative retention techniques.

Source: https://electroiq.com/stats/ai-companions-statistics/

18. The delta: +$0.66 of revenue per download

0.66 doesn’t seem like a lot until you remember that we’re talking about tens of millions of downloads.

This is why this metric is so important. Marginal increases in pricing and cadence can generate enormous returns. This is also a tactical outcome.

Those who succeed will double down and invest more in models, content and personalization which will only further increase the divide going forward. This also has profound implications for the investment thesis.

If you have a category that’s getting better and better unit economics, you don’t need to keep on spinning a flywheel of excitement. You can afford to invest in safety, trust and getting experiences right because monetization is fundamentally sound.

19. Replika scale: 30M+ users (as of Aug 2024, CEO’s number)

Replika reaching 30M users is significant, because it demonstrates companionship isn’t just a flash in the pan.

It’s one of the first examples of a platform demonstrating users will form habits and bonds with a digital character.

It’s historic, because Replika was instrumental in paving many of the dynamics now ubiquitous in the space – companion type classification, gated high intimacy capabilities, digital identity.

It also triggered the first echos of controversy: once millions of people are emotionally invested, product design becomes ethics. You may disagree with many of the decisions made, but at that scale, the appetite isn’t going away.

20. Replika reported later at 40M+ users (report)

Linking to Replika at 40M+ implies that despite various controversies and changes to the service, the product is still growing.

The lesson here is persistence: demand for friendship isn’t lost if one app fails, it remains or moves elsewhere.

For the industry as a whole, the growth of Replika helps us understand that “relationship AI” has mass appeal, rather than appeal to any one group.

It also gives us a glimpse into the future: as the market expands, customers become more discerning. They will judge companions as they judge social media — not just “does this work?” but “is this the right choice for me?”

Source (URL): https://www.businessinsider.com/replika-ceo-eugenia-kuyda-launch-wabi-2025-10

21. Character.ai: 20M+ users (claimed / referenced in research)

The significance of Character.ai’s scale is that it points to a companionship model of “1000 companions” rather than “one special one.”

20M users suggest that this isn’t some niche fan subculture, but a form of mainstream interactive entertainment with emotional heft.

The implications for product are that companions can be companions, teachers, enemies, comfort objects, and roleplay objects. This expansion expands the idea beyond AI girlfriend websites, but also brings with it issues of creators.

Characters are media. Media drive growth.

Access this paper here: https://arxiv.org/pdf/2410.21596

22. Character.ai traffic: 181.2M visits in Nov 2025 (self-reported)

This level of traffic turns Character.ai into a site, not an app. A place users visit over and over, not every so often.

It has several implications: Firstly, with so many visitors, users must be using the app frequently, which is what you want from a companionship app.

Secondly, it points to the existence of a network effect. Not one based on friends, but based on characters, formats, and trends that users can keep discovering.

While we can quibble about the accuracy of the numbers, they point to the site receiving mainstream interest.

Source: https://www.demandsage.com/character-ai-statistics/

23. Character.ai – U.S. monthly app users: 4.42M (self-reported)

The 4.42M U.S. monthly active app users imply the following: friends aren’t only for the desktop, or midnight browser.

They’re for mobile – on-the-go. What this means for the industry is that “micro-sessions” become the norm: a quick check-in, a few minutes conversation, and then we’re back.

This also influences monetization: tokens and streaks play well to the mobile cadence. It also has implications for safety and privacy: mobile usage is more intimate.

24. Candy AI hits ~22M Visits in December 2025

Candy AI received about 22.12 million visits in December 2025, and traffic showed strong momentum with month-over-month increases (up ~20% from November). The average session duration was 6:28 — a strong engagement signal for a web-first AI companion platform.Approximately 76.98% of Candy.ai traffic comes from mobile devices, while just 23.02% comes from desktop.

Candy.ai was ranked #2301 globally in December 2025, reflecting strong visibility among all web properties worldwide, and ranking around #1781 in the U.S.

Most of the Candy AI users report that their favourite feature is the advanced chat functionality, followed by image generation and their AI video tool.

Source: SemRush

25. Mydreamcompanion Website Traffic: ~678.49K visits in December 2025

In December 2025, Mydreamcompanion received approximately 678,490 total visits across all devices.

Users visiting this site spent an average of 12 minutes and 59 seconds per session on the site — much longer than typical social or casual web traffic (which often averages 2–4 minutes).

This suggests Mydreamcompanion.com users are not just clicking through, but actively engaging — likely generating images, reading content, making videos, or starting chat interactions.

Source: SemRush

26. Consumption: 48B hours in generative AI apps (2025)

The 48 billion number is striking because it’s an attention metric rather than a revenue metric.

It’s a number that shows where people are actually spending time online.

Companions work within the pool of attention because they don’t need a use case.

You can open a AI girlfriend chatbot app if you’re bored, lonely, curious, or procrastinating.

This means that generative AI is moving from tool-like use to ambient use. It’s something that people will have open like a social app. Line/area chart of hours (2023–2025).

Consumers Spent More on Mobile Apps Than Games in 2025, Driven by AI App Adoption The AI App-ocalypse: In 2025, consumers spent more on mobile apps than games, a shift driven by the adoption of AI apps.

27. Engagement multiplier: 3.6x compared to 2024

The 3.6× ratio implies that 2025 wasn’t just “more of the same”. There was a point in 2025 where generative AI products became “usable enough”, which can mean a lot of things – like getting the right model on the right platforms with the right UX and distribution, or the market just getting less stigmatized towards AI use.

For companions, that’s huge because it’s a retention-first feature. It works best when users already use AI a lot.

So if we saw that kind of multiplier, that would tell me that at some point in 2025 people really started using AI as part of their everyday apps, not just every-now-and-then.

In 2025, consumer spending on apps outpaced gaming, largely due to the adoption of AI-powered apps.

28. Engagement multiplier: ~10× vs 2023

“Ten times in two years is the kind of growth that changes culture. In 2023, many people were still asking “Why would I talk to an AI?”

By 2025, the question becomes “Which AI do I talk to – and for what?”

The effect is normalization: once behavior is normal, the market fragments into niches and subcultures. That’s when you see companions specialized for anxiety, confidence, dating rehearsal, fandom roleplay, or just daily conversation.

This stat is basically the “permission slip” for the entire companion industry to scale.”

For the first time, consumers spent more money on apps than games in 2025, a trend driven by the rise of AI-powered apps.

29. Intensity of use: 1T sessions in 2025

1T sessions is a frequency story. It means that users launch AI apps frequently – not necessarily for a long time, but often.

This is ideal for companions because companionship is often about little moments: a check-in, a vent, a playful chat, a quick mood boost.

The industry implication is that session-based business models become feasible (tokens, daily packs, micro-upgrades) and that the UX can be optimized for brevity: instant resume, instant recall, instant emotion. Suggested visual: Sessions growth chart; even a single big callout will do.

Consumers spent more on mobile apps than games in 2025, driven by AI app adoption.

30. Confirmation in reporting: Sessions > 1T (2025)

I appreciate this stat because it gets cited in popular reporting that can be traced back to analytics sites.

If several outlets highlight the same figure, I think it helps ensure that number isn’t entirely selected out of context.

The result is a clearly demarcated narrative: “people made AI tools into a routine” is less just a gut feel and more a quantifiable metric. With chatbots, lots of sessions implies more chances for toxic over-reliance… and more opportunities to provide value as a psychological security blanket or learning aid. That’s where the duality lies.

A new report by a leading market research firm is revealing that, for the first time, consumers spent more money on apps than on games in 2025. This change is attributed to increased adoption of AI-powered apps.

31. AI-fueled monetization impact: AI-powered app monthly gross revenues increased 37× in two years

37× growth is an industry-driving result, a sign that business models (subscriptions, paywalls, bundling, pricing psychology) finally started to match demand.

It means increasing competition: money brings new entrants, and also new investment from existing players. It means the platforms (stores, ad networks, analytics) will add category-specific features.

For companions, it will mean even better products — but it will also mean even stronger pressure to keep us engaged, a challenge for safety and ethics.

Source: https://land.appfigures.com/rise-of-ai-apps-report-2025

32. $1.4B+: The amount consumers will spend on AI-enabled applications in 2024

This is the “foundational” metric. Even before we consider 2025, AI applications had already shown willingness to pay at scale.

The resulting effect is confidence: once spending goes over a billion, it’s not speculative.

This spending pays for better models, better UX, and better distribution, which then drives more adoption.

Companions get the benefit because they’re often bundled with other AI (chat, image generation, and even short video generation) and people who are willing to pay for AI in general are more willing to pay for companionship features.

Rise of AI Apps Report: 2025 | Appfigures: https://land.appfigures.com/rise-of-ai-apps-report-2025

33. AI applications market to see over $2B in spending in 2025

Reaching $2B is as psychological as it is financial. It is the threshold beyond which “AI apps” cease to be a fringe category and enter a robust competition with other categories of apps.

The effect is normalization: more conservative users are likely to come on board as the sector starts to feel more “normal”, and more business will start to treat it as a settled fact.

For companions in particular, a larger available market will mean that many previously exceptional features will become everyday: better voice, better graphics, better memory.

On the flip side, the bigger market will also attract more regulatory and legal attention, as large markets often do.

34. Distribution boom: 346M AI app downloads in Q4 2024

346M in a quarter is what “category breakout” looks like. The effect is pipeline: those users don’t stop at December 31st – they roll over into 2025 as installed base, triers, and future subs.

For companions, this matters because much of the adoption happens in phases: try once try again find a favourite pay.

A big quarter of downloads will create a large funnel for 2025 retention and monetisation. Even if only a tiny fraction become paying users, the absolute volumes are still big enough to support a lot of companion businesses.

35. Teen adoption: Two-thirds of U.S. teens have used AI chatbots (2025)

I find this stat a bit of a cultural marker: if two-thirds of teens have tried a chatbot, that means conversational AI isn’t a coming-soon but a here-and-now for them.

The effect is that this sets up a normalisation over time: teens today are the consumers of tomorrow, and they will demand that chatbots be everywhere.

For the chatbot industry, meanwhile, teen users means the stakes change – it’s not just “does it work?” but “is it safe, trustworthy, age-appropriate, transparent?”

Source: https://www.pewresearch.org/internet/2025/12/09/teens-social-media-and-ai-chatbots-2025

36. Teen frequency: About three-in-ten use chatbots daily (Pew Research Center, 2025)

Why it matters: Daily usage is the line in the sand. Once you’re using AI chatbots every day, they aren’t just a curiosity to play with every so often.

You’re treating them like you treat messaging.

This matters because it’s at the point of daily usage that the emotional connection happens. For some teens, this will be about having a source of comfort or a way to experiment with identity.

For others, chatbots will become their go-to advice-givers. This is also where tech companies’ responsibility will get more important.

As AI chatbots become something teens use every day, there’s more risk that they will lead to over-reliance, expose teens to content they shouldn’t see, or create inappropriate boundaries. It also means that the future of companionship products will be shaped by young users.

Source: https://www.pewresearch.org/internet/2025/12/09/teens-social-media-and-ai-chatbots-2025

37. Teen companion usage: 72% have used AI companions (Common Sense Media, 2025)

Why it matters: And now for my last, most surprising stat. Nearly three-quarters of teens have used AI companions.

That’s not niche.

This matters because it shows that AI for companionship is no longer a niche phenomenon.

It’s also a reminder that these products are not always good or bad. They can be fun, fulfilling, and social.

They can also create toxic, manipulative, and risky interactions. As three-quarters of teens have used AI companions, we can expect this to be an area of growth for the industry, as well as an area where we see regulation, innovation, and trust become key differentiators.

Final Thoughts

After writing about all 35 stats, it hit me:

AI companions didn’t explode. They normalized.

They found a home in our schedules. They found a place in our budgets. They found a home in a generation that didn’t find them weird.

In 2025, AI companionship reached a milestone. It went from something people dabbled in to something people stuck with.

And that’s usually how the biggest trends start.

- They don’t show up with a bang.

- They arrive with a hug.

- They get a little emotional.

And they spread faster than we expect.